The third tip in the column on good financial advice is:

Set a periodic budget

Planning is everything in finance. Setting a periodic budget for expenses is essential to avoid living a life beyond your means.

To do this, it is necessary to keep track of net income and expenses to be incurred, only in this way can it be determined-considering savings as well-when to spend each month on necessary expenses (such as bills, rent, and various fees) and extra expenses, i.e., those related to dining out, travel, and shopping. To explore this in more detail, we encourage you to read thein-depth article on financial journaling and useful tools to get started.

A budget can help you pay off an overdue debt, take charge of your financial future, and even become a more peaceful and relaxed person. Depending on the circumstances, an appropriate budget will not necessarily force you to spend less. Instead, it may simply be that you need to make more forward-looking economic decisions.

Today, too, we recommend that you get started right away and get some practical tools to help you keep on top of things in aneasy and fun way.

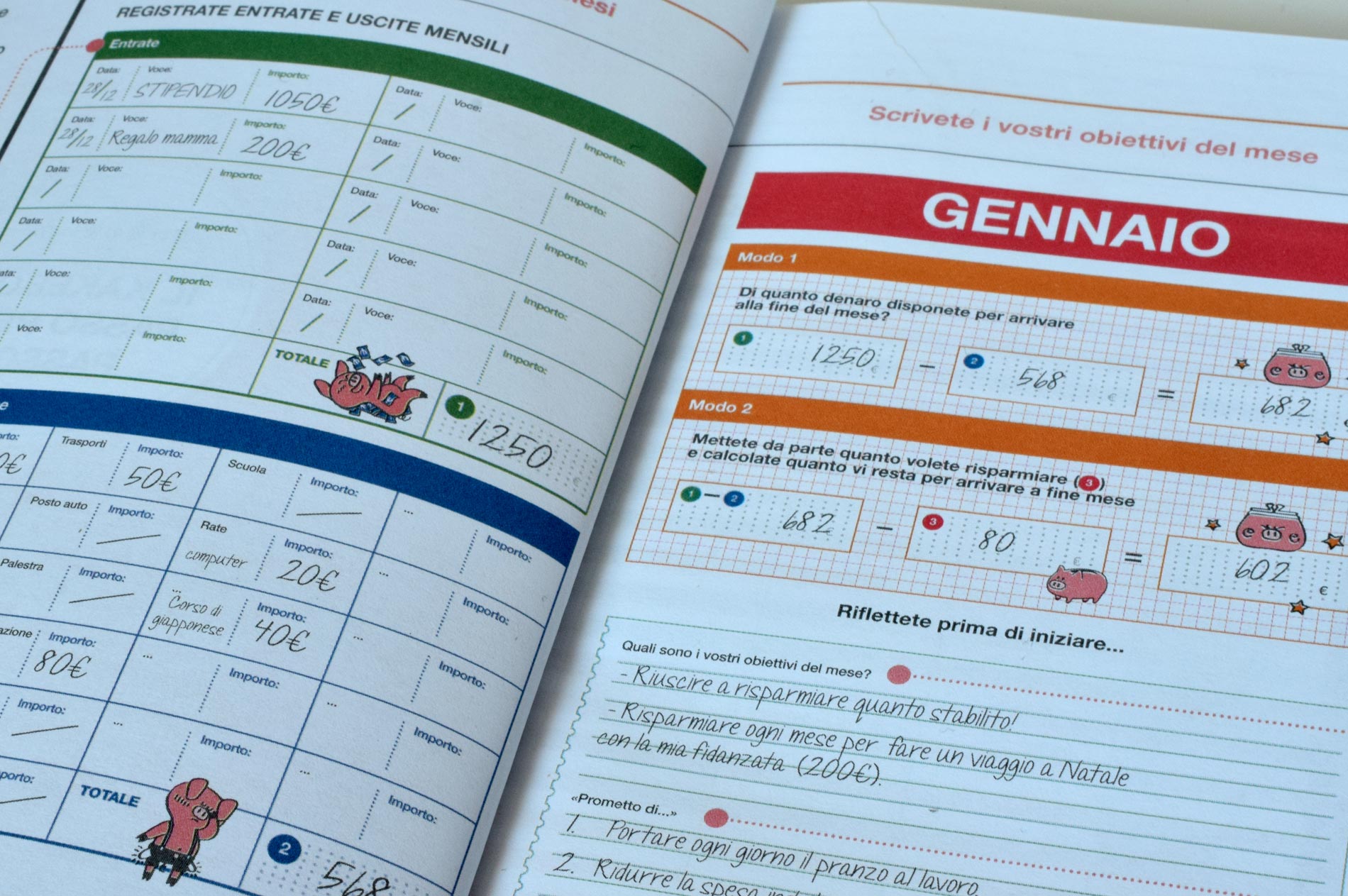

Find out how to keep trackof income and expenses with the Kakebo the home account planner to save money and manage your expenses without stress.

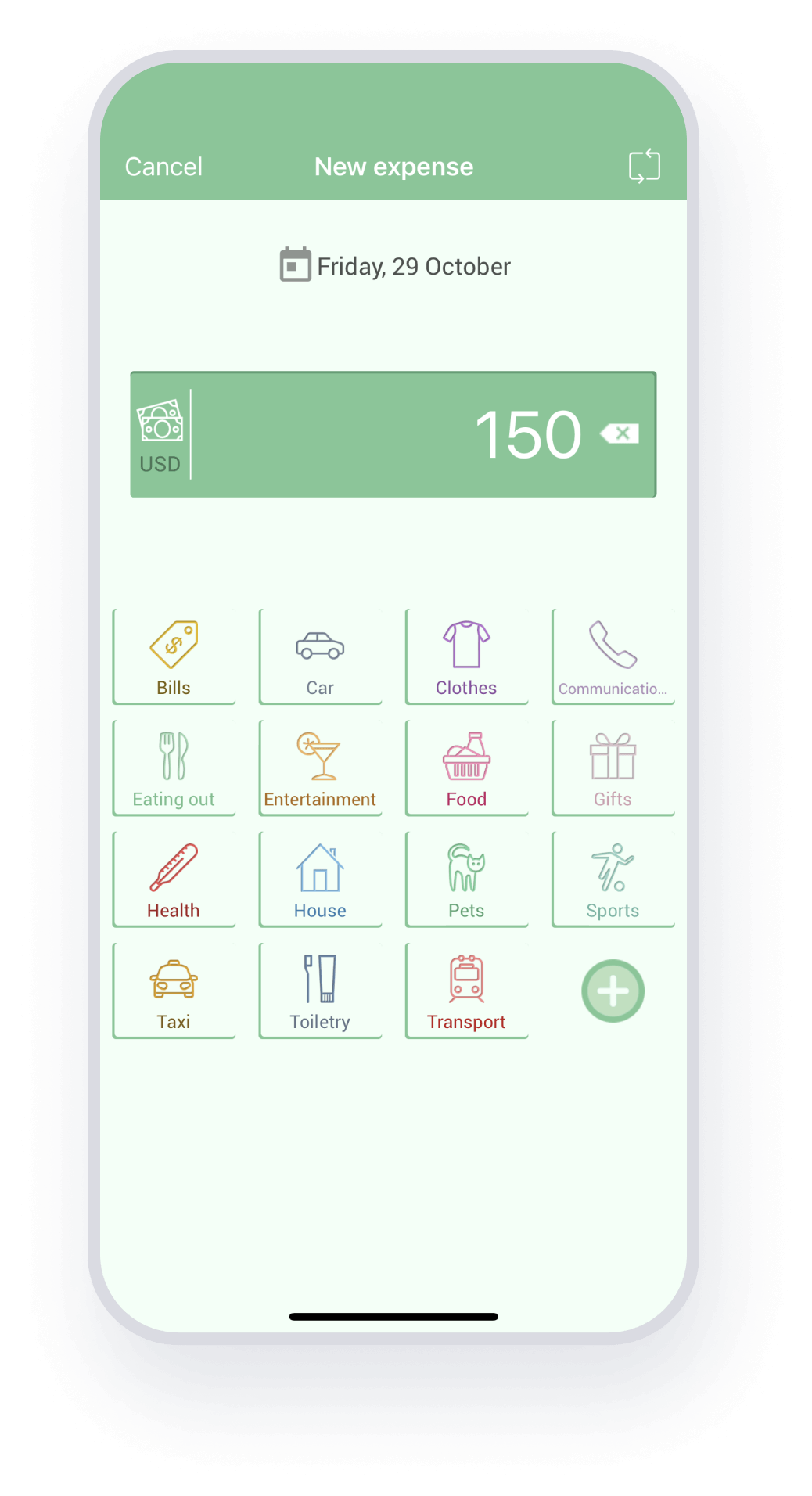

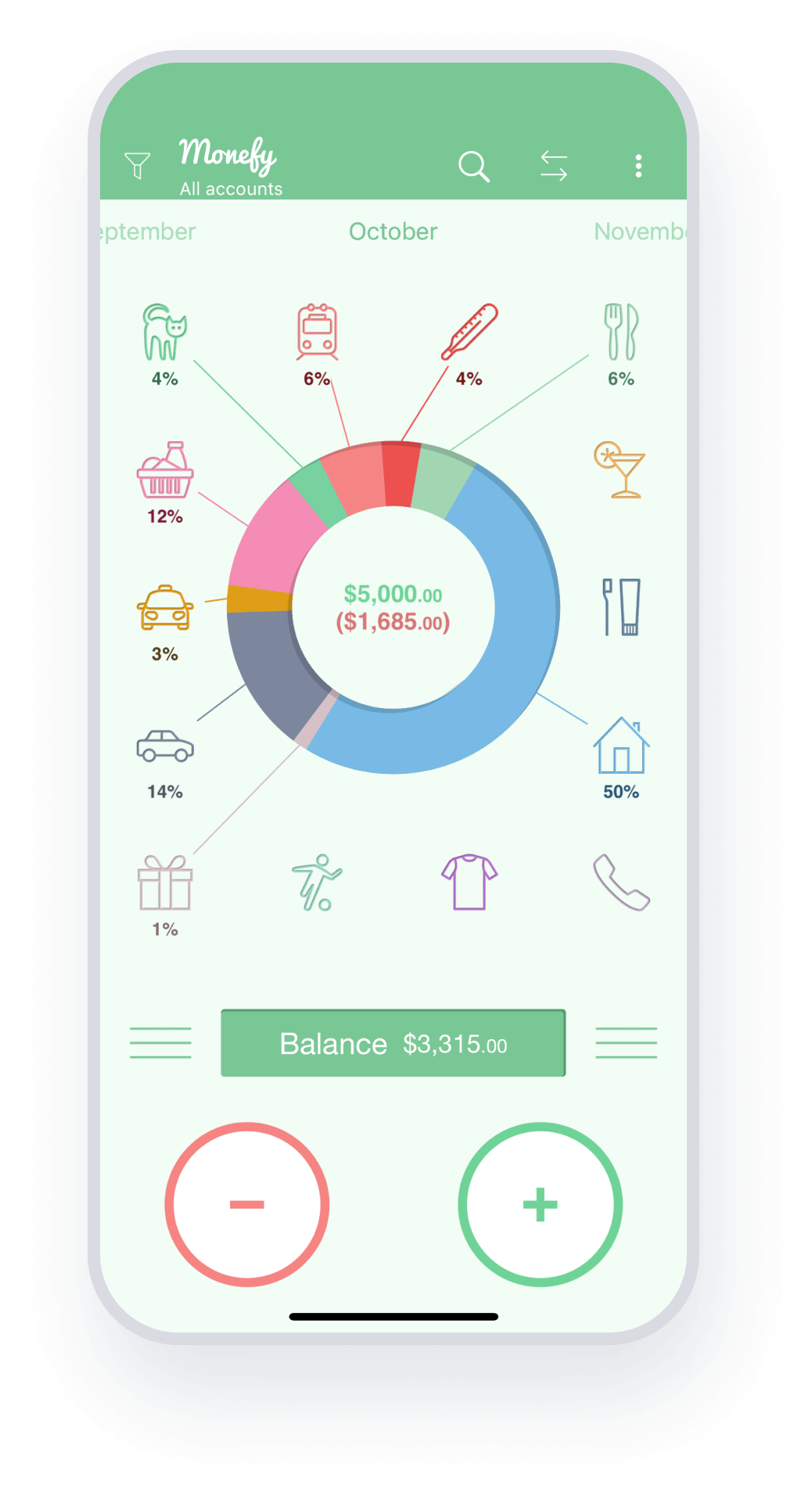

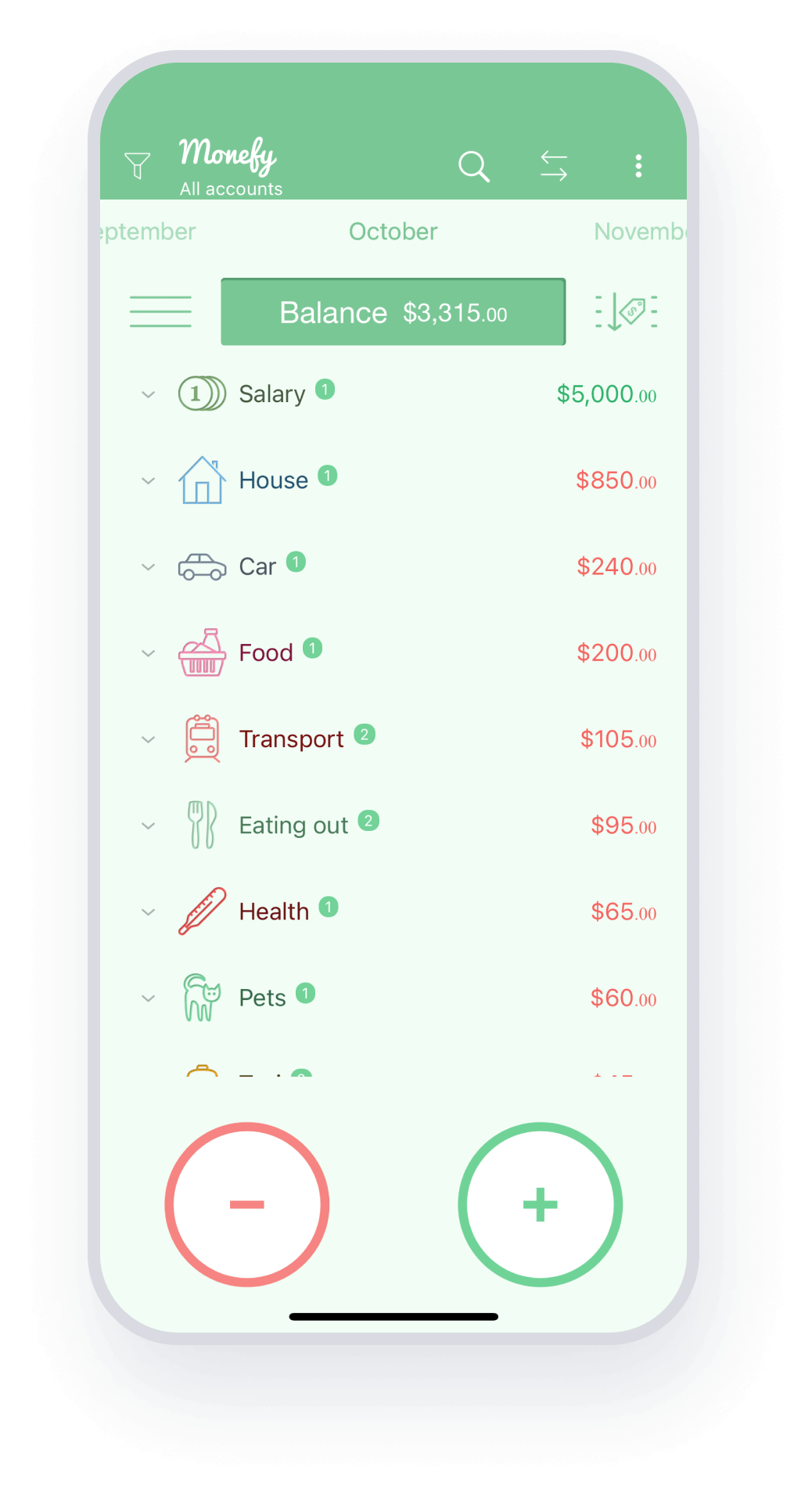

You can also manage everything from your smartphone with a mobile app for expense management. There are several and with different functions.

Here we recommend one that we think has all the necessary tools. It is called Monefy and is available for iOS and Android.

We deal with over-indebtedness prevention related to usury risk every day throughlistening, counseling and support. We are approached by employees and retirees who are in a situation of imbalance between income and expenses and cannot pay their debts.

In the video we show you the steps to follow to receive free support.

If you find yourself in a similar situation, please contact us!

Learn about other financial best practices

Good financial advice #22 | Watch less TV

Television is definitely a source of shopping inspiration, advertising unfortunately stimulates and ignites cravings and needs and pushes us to buy perhaps unnecessary items.

Good financial advice #21 | If you can buy it twice you can afford it

Shopping is an activity that has become easier and more fun over the years. Shopping, online or offline, has never been easier. This over-simplification of the purchasing process, however, hides some dangers that may lead us to not think through the purchase and thus overrun our budget. Here are some simple but useful tips to avoid crazy purchases.

Good financial advice #20 | Read a financial book every year

Reading to be more informed and to understand what strategies to adopt in managing personal finance and what mistakes not to make is the first step in increasing our knowledge.

Follow us on our social media