Origins

In the late first half of the 1990s, close and tragic news stories about victims of usury had led the Adventist Church to take an interest in the social scourge with the intention of making its own contribution. At the end of 1994, some pastors and missionaries of the church encountered worn-out people and others who were “at risk,” that is, completely excluded from the banking world, one step away from falling into the “trap” of moneylenders. While it is clear that for current usury the only possible avenue that should be promoted is denunciation, for families at risk it was possible to build something alternative. A path to be taken together, to bring to light the debts, which the person almost hides even from himself, and not to make him feel lonely. Also, find ways to make the person’s name trustworthy again in the banking circuit. How? Guaranteeing for her at banks, making it easier to obtain a loan with which to close those loans, bank overdrafts, rent arrears or mortgage payments that she could no longer manage. In short, and real second chance.

Moral Body

After the first experiments with guarantee provision for some families, in 1995 the

Italian Union of Seventh-day Adventist Christian Churches.

, decides to use part of the funds of the

8xmille

given to her each year, to the establishment of the “ Adventum Foundation – Fund for Solidarity and Anti-usury Onlus.” On February 15, 1996, Adventum became a Moral Entity by Ministerial Decree of December 16, 1996. The following year, with the enactment of Law 108/96, Aventum is registered on the list of anti-usury foundations and associations receiving funds dedicated to guarantee benefits.

Anti-usury activities

Thus officially begins the work of managing the ministerial fund dedicated to anti-usury. The law, which is broad and articulate, addresses both the usurious and those at risk of falling under usury. For the actual victims, Adventum, together with SOS Impresa of the Confesercenti of Rome, the658 Association and Vita magazine, in 1996 established the RomeAnti-usury Outpatient Clinic where lawyers, psychologists, accountants, pastors, all volunteers, listen to the person from the point of view of their expertise and accompany him or her toward denunciation. At the City of Rome in the late 1990s, Adventum participated with its volunteers for four years in running a desk for victims who report crime and can prove the debts created and accumulated during usury. The experience is thus broadened and one can touch the drama, but also the complexity, of the consequences of usury suffered in families, where destitution, threats, anguish and suicidal thoughts become protagonists of everyday life. The collaboration ends with the closing of the long project of the City of Rome and the legal reinforcement brought about in this regard by Law 108/96. For those, on the other hand, who are in such a state of indebtedness that they are in danger of falling into the net of moneylenders, again since 1996, the provision of guarantees from the funds of the Ministry of Economy and Finance (MEF) has been continued and consolidated.

Fund management that may appear as niche work because the instrument is framed in peculiar parameters that the MEF itself defines. This is an intervention that involves and links administrative, legal, and human aspects. The people targeted have income from employment, or retirement, and may even be able to sustain a monthly payment, but their creditworthiness is now compromised and only case co-management with the Foundation can ferry them out of the impasse. Without assessing the specifics of various debts (due date, number of installments in arrears, real consequences in case of non-payment, their history), and without valuing the resources the person has, we risk giving the person the wrong message: we close debts by making more debts. Only in some cases is this denouement the only solution. In Adventum, this is something that has been well captured over the years by offering a different message, moving from “entity that guarantees risky loans” to “anti-usury listening and guidance center.”

Concrete support for families

From 2003 to 2009 and again since 2015, Adventum also collaborates with the Lazio Region participating in the calls provided by two laws, 23/2001 first, and 14/2015 currently, thanks to which it can support additional families in the Latium region on their way out of over-indebtedness and acquire personal management autonomy. The inevitable errors of judgment made, the upward trend in consumption, the epochal lira-euro transition with its consequences on the economy, the economic crisis of 2008, the change in social mores with the digital revolution and the great focus on communication, and the crisis due to the Coronavirus19, are aspects that have led to important reflections in family care. Everyone changes together. And there is an understanding of how a real change in facing resources and commitments must take place, how an anti-debt culture must settle deeply in the person.

Prevention to younger people

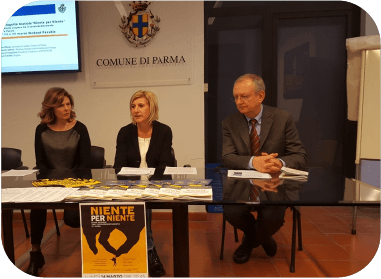

The kind of path taken with the user and the results achieved together (assessment of debt status and family budget management status, awareness raising, revision of the person’s position toward the problem, no longer a victim of debts and taxes but a manager of his or her own income, entrepreneur of the “family” business, new family budget highlighting the rescheduling of priorities) are the aspects given voice and value during the meetings, but there has been an increasingly strong sense over the years of the need to engage in prevention on the educational and training front as well. Therefore, in 2016, Adventum and Anti-Use Outpatient Clinic are offering the public an artistic reflection on the topic of usury and over-indebtedness with a theater performance of Nothing for Nothing. Thus, one chooses to contribute to raising awareness of an issue about which one is aware will need to be constantly confronted and updated.

Adventum Foundation prevents usury risk

Supporting people in economic hardship.